The financing landscape in Singapore has witnessed a significant shift over the years, especially with the rise of technology. Traditional bank loans, once the primary option for businesses, are now sharing the stage with a more accessible and efficient solution: Aggregator Platforms for Business Loans. These platforms offer an innovative way for companies, both large and small, to access funding without navigating the lengthy processes and strict requirements of conventional banks.

What Is an Aggregator Platform for Business Loans?

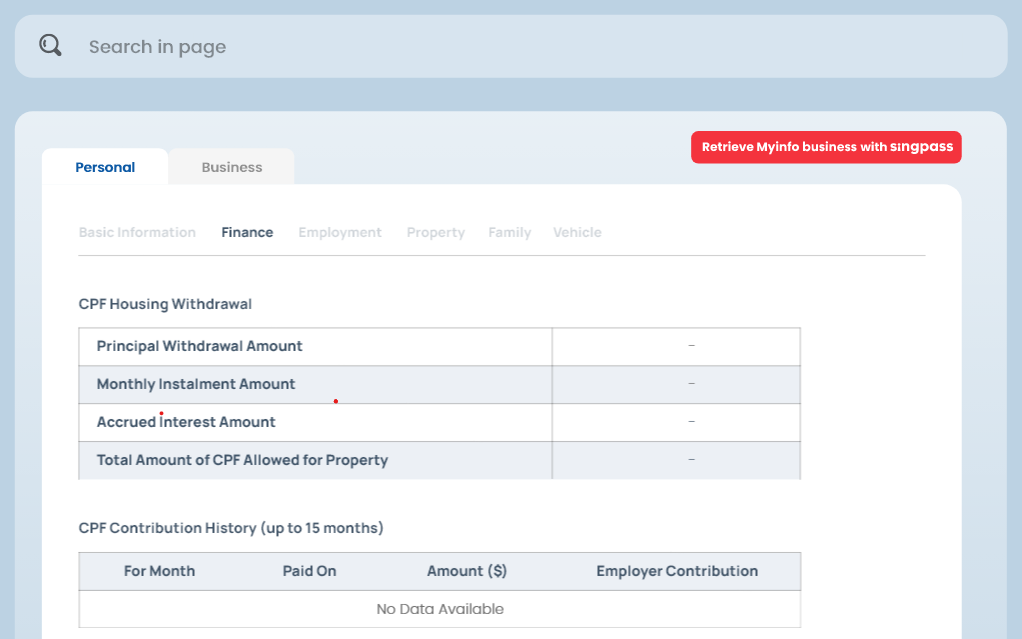

An aggregator Platform for Business Loan functions as a one-stop solution for companies looking for financing options. These platforms gather offers from multiple lenders, including banks, fintech companies, and private lenders, giving businesses the power to compare rates, terms, and conditions easily. By using these platforms, companies can evaluate different options quickly, choose the most suitable loan product, and receive funds much faster than the traditional loan application process.

The Advantages of Using an Online Loan Platform in Singapore

Singapore’s financial ecosystem has adapted swiftly to digital trends, and Online Loan Platforms in Singapore have gained popularity for many reasons. These platforms offer businesses an array of benefits that simplify and enhance the loan application process. Convenience, speed, and transparency are the top advantages, allowing entrepreneurs to focus more on their business rather than the complexities of acquiring financing. With minimal paperwork and quick turnaround times, these platforms cater to modern businesses’ fast-paced needs.

How Aggregator Platforms Save Time and Boost Efficiency

In the current dynamic business environment, time is crucial. Aggregator Platforms for Business Loans eliminate the need for businesses to visit multiple banks or lenders physically. Instead, companies can browse and compare various loan products on a single platform. This process not only saves time but also ensures businesses can make informed decisions. Lenders on these platforms often present competitive rates to attract businesses, which leads to better deals for companies seeking loans.

Tailored Financing Solutions Through Online Platforms

Another benefit of using an Online Loan Platform in Singapore is the range of customized solutions available. Whether a business needs short-term working capital, equipment financing, or long-term growth capital, online platforms aggregate a diverse set of lenders, ensuring that companies can find a solution tailored to their specific needs. With an emphasis on flexibility, these platforms are an excellent tool for businesses with unique requirements or fluctuating financial situations.

Enhancing Access to Finance for SMEs

Small and Medium Enterprises (SMEs) in Singapore often face challenges when it comes to securing financing from traditional institutions due to strict eligibility criteria. Aggregator Platforms for Business Loans and Online Loan Platforms in Singapore have leveled the playing field for SMEs by providing greater access to funding. These platforms are designed to offer loan options that fit the financial standing and goals of smaller businesses, ensuring they have the support needed to grow and thrive.

Conclusion

As technology continues to reshape the financial sector, the role of Aggregator Platforms for Business Loans and Online Loan Platforms in Singapore will only become more prominent. Businesses of all sizes can leverage these tools to gain access to vital funding in a streamlined and efficient manner. The evolution of online loan platforms is opening new doors for companies that seek fast, flexible, and tailored financing solutions. To learn more about business loans, visit smart-lend.com.